The energy demand in our country is rising due to an expanding economy, growing population, increasing urbanization, evolving lifestyles, and rising spending power. About 98% of the fuel requirement in the road transportation sector is currently met by fossil fuels and the remaining 2% by biofuels. Today, India imports 85%2 of its oil requirement. The Indian economy is expected to grow steadily despite temporary setbacks due to the COVID pandemic. This would result in a further increase of vehicular population, increasing the demand for transportation fuels. Domestic biofuels provide a strategic opportunity to the country to reduce the nation’s dependence on imported fossil fuels. In addition, when utilized with appropriate care, biofuels can be environmentally friendly, sustainable energy sources. They can also help generate employment, promote Make in India, Swachh Bharat, doubling of farmers’ incomes and promote Waste to Wealth generation.

Ethanol is one of the principal biofuels, which is naturally produced by the fermentation of sugars by yeasts or via petrochemical processes such as ethylene hydration. It has medical applications as an antiseptic and disinfectant. It is used as a chemical solvent and in the synthesis of organic compounds, apart from being an alternative fuel source.

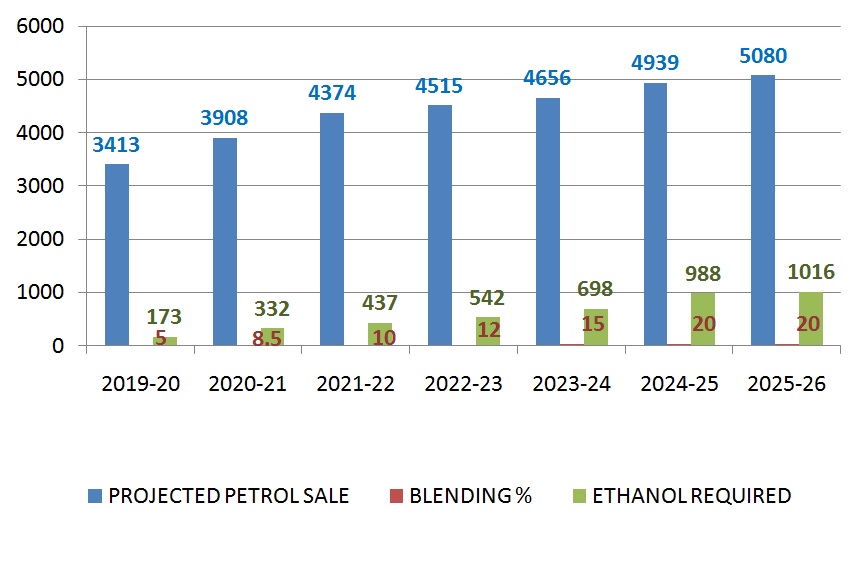

The National Policy on Biofuels – 2018, provides an indicative target of 20% ethanol blending under the Ethanol Blended Petrol (EBP) Programme by 2030. Currently petrol with 10% ethanol blend (E10) is being retailed by various Oil Marketing Companies (OMCs) in India, wherever it is available. However, as sufficient quantity of ethanol is not available, only around 50% of petrol sold is E10 blended, while remaining is unblended petrol (E0). The current level of average ethanol blending in the country is 5% (Ethanol Supply Year 2019-20). Due to several interventions in the supply side of ethanol, the Ministry of Petroleum aims to achieve 10% ethanol blending levels in the Ethanol Supply Year (ESY) – 2021-22 i.e. April, 2022. This step along with achieving E20 targets will require emission norms for nationwide standardization and adoption. The MoRT&H has notified BS-VI emission norms in Central Motor Vehicle Rules 1989 which apply to all vehicles post 1st April 2020. Newer vehicles on E-20 will have to meet BS-VI norms. MoRT&H has notified GSR 156(E) on 8th March 2021 for adoption of E20 fuel as automotive fuel and issued mass emission standards for it. MoRT&H has also notified Safety standards for ethanol blended fuels vide GSR 343(E) dated 25th May, 2021 based on Automotive Industry Standard3 (AIS 171). It lays down safety requirements for type approval of pure ethanol, flex-fuel & ethanol-gasoline blended vehicles in India.

Currently the gasoline vehicles (2 wheelers & 4 wheelers) in the country are designed for running on pure gasoline and can be tuned to suit ethanol blended fuels ranging from E0 to E5 depending on the vehicle type. On the material compatibility front, the rubber and plastic components are compatible with E10. However, with the proposed target of E20, the vehicles are now required to become both material compatible and tuned for use of E20 fuel.

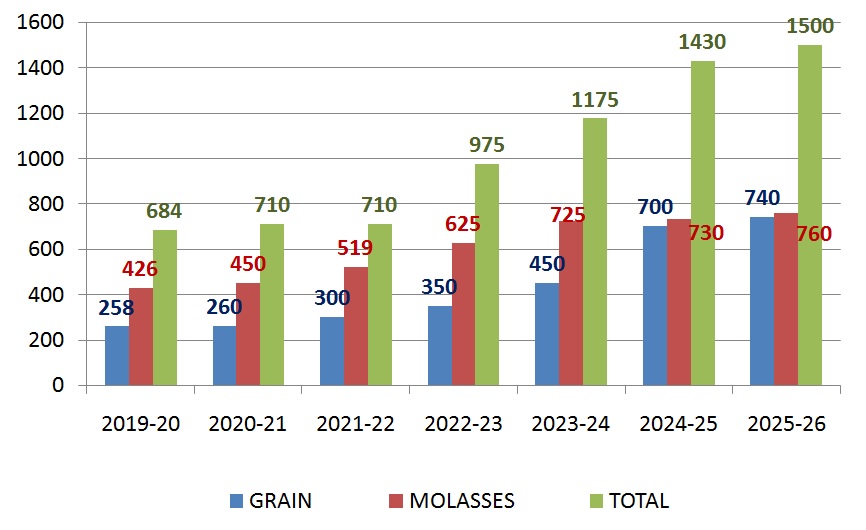

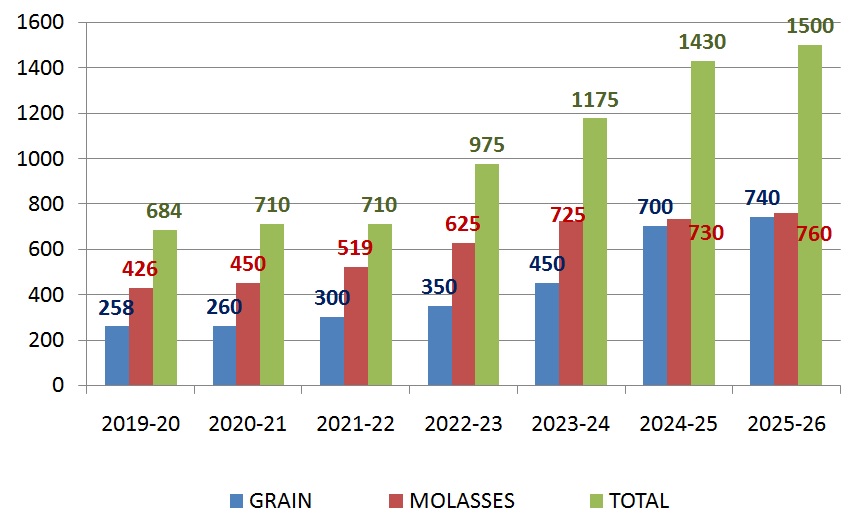

By taking into consideration the limitation of ethanol production from traditional C-Heavy molasses route and its competitive usage in potable and chemical sectors, the Central Government has allowed other sugarcane and food grain-based raw materials for ethanol production in line with the National Policy on Biofuels, 20184. However, the existing combined alcohol/ethanol distillation capacity of 684 crore liters will have to be augmented for which this report attempts to provide a roadmap.

The task force on sugarcane and sugar industry5 constituted under the Chairmanship of Professor Ramesh Chand, Member (Agriculture), NITI Aayog estimated that sugarcane and paddy combined are using 70% of the country’s irrigation water, depleting water availability for other crops. Hence there is a need for change in crop pattern, to reduce dependence on one particular crop and to move to more environmentally sustainable crops for ethanol production. Cereals, particularly maize, and Second Generation (2G) biofuels with suitable technological innovations offer promise of a more environmentally benign alternative feedstock for production of ethanol.

Besides, the entire supply chain and logistics of OMCs needs to be augmented to store, handle and dispense E20 blends.

As per the decision of the CCEA in its meeting of 21.12.2020, the Government aims to advance adoption of 20% blending in gasoline in the country by 2025. Accordingly, MoP&NG, DFPD, DHI and MoRT&H have worked out a plan to achieve this target, which this report synthesizes.

International Practices on Ethanol Blending in Petrol

Global transportation sector is facing three major challenges, namely depletion of fossil fuels, volatility in crude oil prices and stringent environmental regulations. Alternative fuels specific to geographies can address these issues. Ethanol is considered to be one of most suitable alternative blending, transportation fuel due to its better fuel quality (ethanol has a higher octane number) and environmental benefits. The global production of fuel ethanol touched 110 billion litres in 2019 showing an average growth of 4% year per year during the last decade. The United States of America (USA) and Brazil contribute for 92 billion litres (84% of global share) followed by European Union (EU), China, India, Canada and Thailand. To increase the availability of ethanol for transport use, many initiatives have been taken by various countries across the world (Table 2.1). Brazil legislated that the ethanol content in gasoline sold in the country should be in the range of 18% to 27.5%, which is currently at 27%. Concurrently, the use of 100% hydrous ethanol by flex-fuel vehicles in Brazil has increased the average share of ethanol in transportation, to 46% in 2019.

STUDIES ON E20 IN INDIA

A project to study the suitability of 20% ethanol-gasoline blend (E20) with in-use vehicles was undertaken by Automotive Research Association of India (ARAI), Indian Institute of Petroleum (IIP) and Indian Oil Corporation (R&D) during 2014-15, with a funding from Department of Heavy Industry (DHI) [8]. Material compatibility tests revealed that the metals and metal coatings had no issue with E20. Elastomers (NBR/PVC blend and Epichlorohydrin) had inferior performance with E20 compared to neat gasoline. Plastic PA66 had a drop in tensile strength after use with E20. In the vehicle level studies, fuel economy decreased up to 6% (depending on the vehicle type) on an average basis. The test vehicles passed startability and drivability tests at hot and cold conditions with E0 and E20 test fuels. In all the cases, there was no severe malfunction or stall observed at any stage of vehicle operation. No abnormal wear of engine components or deposits or deterioration of engine oils were observed after the on-road mileage accumulation trials.

MATCHING HIGHER ETHANOL BLENDS AND COMPLIANT VEHICLES

To use higher ethanol blends, the vehicles are supposed to be designed holistically to take care of material compatibility, engine tuning (spark timing) and optimization (compression ratio)

to garner the advantage of higher octane ethanol blends. However, high compression ratio engines may face catastrophic failure due to engine knocking when operated with low or nil ethanol content (i.e. low octane fuel). Similarly, the vehicles which are designed for low or nil content of ethanol in gasoline will result in lower fuel economy if used with higher ethanol blends.

RESEARCH PROJECTS UNDERTAKEN IN OTHER COUNTRIES

Joint studies reported by Massachusetts Institute of Technology and Honda R&D indicate that the improvement in relative efficiency upto 20% can be achieved with E20 compared to normal gasoline, when the engine is properly tuned. [9]. Trials undertaken by Ford Motor Company concluded that the engine optimized for E20 fuel showed comparable volumetric fuel economy (mileage) and range (kilometers travelled in single fill) of normal gasoline with a CO2 reduction of 5%.

FLEX FUEL VEHICLES (FFVS)

Flex Fuel Engine technology (FFE) is a well-accepted concept in Brazil, representing over 80% of the total number of new vehicles sold in the country (2019). The Flex fuel vehicles used in Brazil operate with E27 or E100 Hydrous ethanol or any blend between these two. The vehicle technologies for ethanol are already proven along with the compatible fuel systems globally. So, the selection and optimization of technology for the engine has to be undertaken considering the availability of fuel ethanol. The cost of flex fuel vehicles (four-wheelers) would be higher in the range of Rs 17000 to Rs 25000. The two-wheeled flex fuel vehicles would be costlier in the range of Rs 5000 to Rs 12000 compared to normal petrol vehicles (SIAM).

IMPACT ASSESSMENT OF USAGE OF E20 FUEL

Vehicular emissions such as Carbon Monoxide (CO), Hydrocarbons (HC) and Oxides of Nitrogen (NOx) are currently under regulation in India. Use of ethanol blended gasoline decreases these emissions. A summary of emission benefits with E10 and E20 fuels compared to neat gasoline.

Higher reductions in Carbon Monoxide emissions were observed with E20 fuel – 50% lower in two-wheelers and 30% lower in four-wheelers. Hydrocarbon emissions reduced by 20% with ethanol blends compared to normal gasoline. Nitrous Oxide emissions did not show a significant trend as it depended on the vehicle/engine type and engine operating conditions. The unregulated carbonyl emissions, such as acetaldehyde emission were, however, higher with E10 and E20 compared to normal gasoline, due to the presence of hydroxyl groups in ethanol. However, these emissions were relatively minor (in few micrograms) compared to regulated emissions (which were in grams). Evaporative emission test results with E20 fuel were similar to E0. Overall, ethanol blending can help decrease emissions from both two-wheelers and four-wheelers.

Impact on the consumer

Fuel Efficiency: While using E20 fuel, there will be a drop in fuel efficiency by nearly (a) 6-7% for 4 wheelers designed for E0 and calibrated for E10, (b) 3-4% for 2 wheelers designed for E0 and calibrated for E10 (c) 1-2% for 4 wheelers designed for E10 and calibrated for E20 [8]. However, with the modifications in engines (hardware and tuning), the loss in efficiency due to blended fuel can be reduced.

Startability: In the E20 project [8], the results indicated that the test vehicles passed startability and drivability tests at hot and cold conditions with E0 and E20 test fuel. In all the cases, there was no severe malfunction or stall observed at any stage of vehicle operation.

Impact on the vehicle manufacturer

The following changes in the production line will be necessary to produce compatible vehicles. 1. Engines and components will need to be tested and calibrated with E20 as fuel. 2. Vendors need to be developed for the procurement of additional components compatible with E20. All the components required can be made available in the country. 3. No significant change in the assembly line is expected.

Impact on the component manufacturer

1. There will be no major structural change in the components in migrating from E10 to E20. 2. There will be changes in material of piston rings, piston heads, O-rings, seals, fuel pumps etc., all of which can be produced in the country.

VIEWS OF AUTOMOBILE INDUSTRY

The committee has also considered various inputs given by Society of Indian Automobile Manufacturers (SIAM), details of which are at Annexure-D. A gist of the same is given below. 1. Vehicles made in India since 2008 are material compatible with E10 and fuel-efficient compliant with E5. At the next stage when E10 is made available across the country, new vehicles can be made fuel efficient compliant by engine modification with E10. 2. Shift to E20 fuel is a logical, direct progression from E10 rather than going through intermediate steps of E12 and E15. However, following concerns are to be taken care: E20 should be made available on a pan India basis. E10 should be made available on a pan India basis as protection grade fuel for existing pool of vehicles 3. E100/Flex Fuel Vehicles: The cost of E100/ Flex fuel vehicles will be higher in comparison to E0/E10 vehicles which may result in an increase in total cost of ownership (TCO) for the customer. SIAM has suggested that only when E100 can be sold at 30% lower cost as compared to gasoline and if E100 fuel is available across the country can the flex fuel vehicles be a possible solution. Hence, SIAM has not recommended pursuing an E100 implementation / flex fuel approach for the time being. However, once fuel is available on a pan-India basis, a decision on promoting E100 vehicles can be taken.

4. Retro-fitment on existing Vehicles: The existing vehicles on road are material compatible to E10 but their engine/vehicles are not tuned to E10 for optimum performance efficiency. Developing parts with upgraded material for a large number of vintage variants with a wide range of fuel system component designs and then getting the customers to get their vehicles upgraded is a mammoth task. Keeping this complexity in view, a recommendation to continue dispensing E10 as a protection grade fuel all over the country has been made.

5. Alignment of changes with emission regulations: Adopting engines with higher ethanol blend means changes in engine hardware and also engine calibration (tuning). AutoIndustryis already working on the engine upgradation work for the next level ofregulations (BS 6.2). Being a huge, unmodifiable task which cannot be course corrected, fuel changes must be also aligned with these regulations to derive complete benefit from all the perspectives.

6. One Nation One Fuel specification: In the past, OMCs and OEMs (Oil and Auto industry) moved together for implementation of BS6 emission regulations and specification of a single fuel across the country. This needs to continue in future also to ensure portability of vehicles by customer, especially for vehicles designed for higher blends of ethanol keeping in mind the customer’s acceptance and requirements.

Ethanol Demand Projection

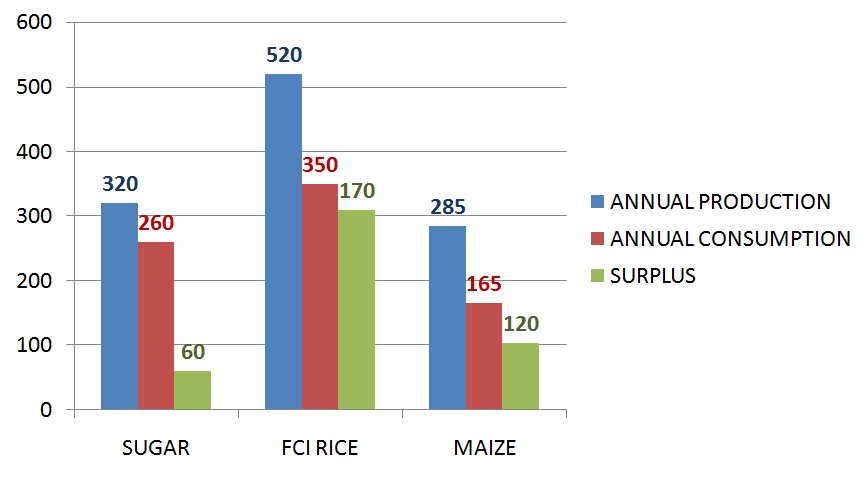

Availability of feed-stock for Ethanol in the Country (In Lakh Ton)

To produce 684 crore litres of ethanol by the sugar industry by 2025-26, sugarcane equivalent to 60 LMT of surplus sugar would be diverted to ethanol. In the current sugar season 2020-21 more than 20 LMT of sugar is estimated to be diverted. To produce 666 crore litres of ethanol/ alcohol from food grains by 2025-26, about 165 LMT of food grains would be utilized. At present damaged food grain availability is around 40 lakh ton in the country. In 2020-21 approximately 20 lakh ton maize is surplus; FCI Rice is also sufficient in stock (266 LMT) and it will continue to remain robust as procurement of paddy/rice at MSP continues at expected levels. The country is producing sufficient food grains and sugar to meet the requirement for ethanol.

Second Generation (2G) Bio-Refineries (using ligno-cellulosic biomass as feedstock) are planned to be set up in areas having sufficient availability of biomass so that ethanol is available for blending throughout the country. Already Rs. 1969.50 Crores have been earmarked for this scheme. These plants can use feedstocks such as rice straw, wheat straw, corn cobs, corn stover, bagasse, bamboo and woody biomass, etc.

Ethanol capacity requirement by Year and Raw Material IN CR. LTR

The above table showing the Grains and Molasses based Ethanol Production Capacity necessary to meet the Production Projections above.

Note: Minor shortfall in capacity in any year can be compensated as sugar mills are also using sugar rich feed stocks like B heavy molasses / sugar syrup which produces 20% more ethanol of rated capacity. Now many mills have started using these feed stocks in place of C heavy molasses. The capacity utilization in these 5 years vary from 84 percent to 90 percent.

Ethanol capacity requirement by Year and Raw Material IN CR. LTR

1. Ethanol is not produced or available in some states for blending with gasoline 2. About 50% of total pump nozzles in India are supplying only E0 3. Restrictions on inter-state movement of ethanol due to non-implementation of the amended provisions of Industries (Development & Regulation) Act, 1951 by all the States. As on date only 14 states have implemented the amended provisions. The other states with a large consumption of petrol where implementation is pending includes Delhi, Uttar Pradesh, Rajasthan, West Bengal, Telangana, Odisha and Kerala. 4. Ethanol blending has not been taken up in North-East states due to non-availability of feedstock or industries 5. Transport of ethanol to different places for blending will increase the cost of logistics and transport related emissions

The Roadmap For Ethanol Blending

The government of India has advanced the target for 20 per cent ethanol blending in petrol (also called E20) to 2025 from 2030. E20 will be rolled out from April 2023.

This measure is aimed at reducing the country’s oil import bill and carbon dioxide pollution. This new initiative is also part of measures to improve energy security and self-sufficiency measures.

The central government has also released an expert committee report on the Roadmap for Ethanol Blending in India by 2025. The roadmap proposes a gradual rollout of ethanol-blended fuel to achieve E10 fuel supply by April 2022 and phased rollout of E20 from April 2023 to April 2025.

Currently, 8.5 per cent of ethanol is blended with petrol in India. To introduce vehicles that are compatible the committee recommends roll out of E20 material-compliant and E10 engine-tuned vehicles from April 2023 and production of E20-tuned engine vehicles from April 2025.

For setting up the ethanol manufacturing plant go to the contact page https://strotam.org/contact/ or call us @9399140969.